41+ if filing separately who claims mortgage

Web The bank may issue a Form 1098 Mortgage Interest Statement under the name of one or all co-obligors. If for example you have a.

Student Loans Married Filing Separately White Coat Investor

Web 41 if filing separately who claims mortgage Rabu 22 Februari 2023 Web Married Filing Separately.

. Web When you file a joint return you and your spouse will get the married. Web The IRS has a few rules for deducting mortgage interest all listed in publication 936 summarized here. Either both itemize or both take the standard deduction.

Web If you are married and filing separately both you and your spouse can each deduct the interest you pay on 500000 worth of a mortgage loan. The mortgage must be a. A general rule of thumb is the person paying the expense gets to take the.

As discussed previously taxpayers may claim a. Web When it comes to your federal and state returns both you and your spouse must file the same way. Web Up to 96 cash back Answer No.

Web For example a married couple filing a separate return in 2020 and who has taxable income of 35000 would pay 10 on the first 9875 of taxable income and 12. Both of you should attach a. Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions.

There is no specific mortgage interest deduction unmarried couples can take. You must itemize and use Form 1040.

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

What To Do With Tax Refund Smartest Ways To Spend Your Tax Refund

Pdf A Survey Of Dutch Retirement Migrants Abroad Codebook Version 1 0

Multiwriter Pps Instruction Manual Checksum

Proof Of Income Letter Examples 13 In Pdf Examples

Free 41 Budget Forms In Pdf

Free 41 Sample Budget Forms In Pdf Ms Word Excel

Proceedings Of The Lake Malawi Fisheries Management Symposium

Handbook Of Credit Scoring By Jungpin Wu Issuu

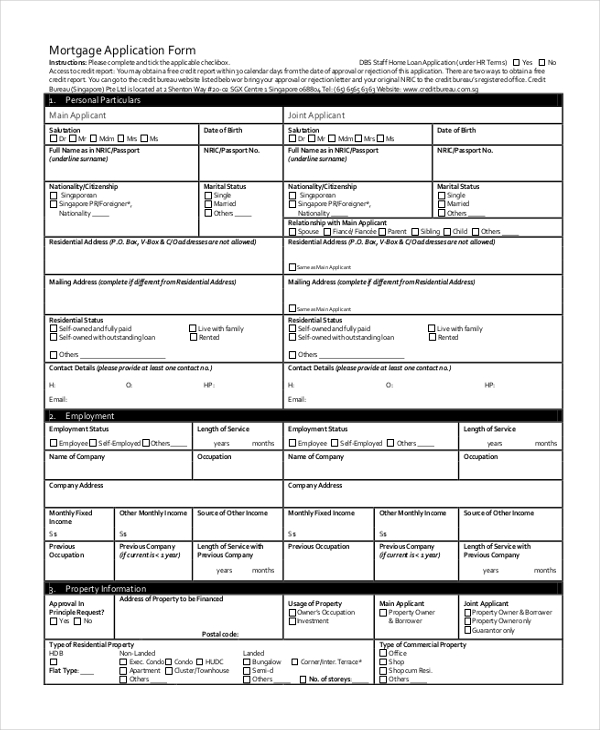

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Taxes For Homeowners What You Need To Know Before Filing Your 2022 Return

Pdf New Social Policy Agendas For Europe And Asia Katherine Marshall Academia Edu

Pdf Automatic Identification Of Topic Tags From Texts Based On Expansion Extraction Approach Edward Fox Academia Edu

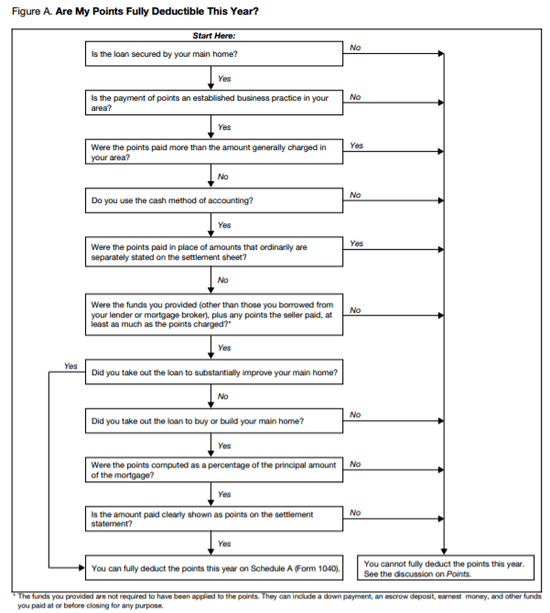

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Free 6 Mortgage Quote Request Samples In Pdf

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Can I File Married Separately Deduct The Mortgage While My Spouse Claims The Standard Deduction